2021 Charitable Deductions

2021 Charitable Deductions As the end of the 2021 tax year is approaching, a re ...

Current Tax Rules for Crypto-Assets

As you may have heard, the government is looking closely at crypto-currency and ...

How the IRS Communicates with Taxpayers

As a reminder, first contact from the IRS is generally a letter delivered by the ...

What to do (and not do) with an IRS Notice

As a reminder, the IRS (and many other tax agencies) will never reach out to you ...

529 Contribution Changes for Arizona Returns

The State of Arizona Individual Income tax return allows a deduction for contrib ...

IRS Continues to have Service Disruption

Are you still waiting for a refund or a response to a letter sent to the IRS? I ...

What employee fringe benefits are taxable?

Due to the current tough labor market, many employers are looking for various wa ...

Are you financially prepared for a natural disaster?

The IRS has released Tax Tip 2021-115, an excellent reminder to be financially p ...

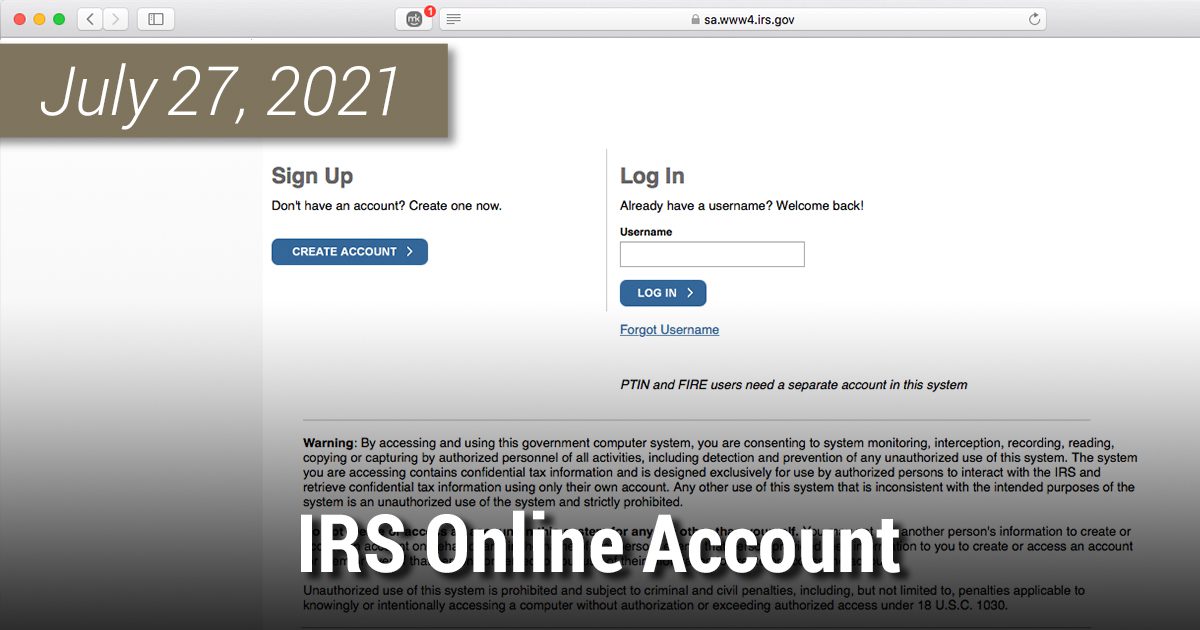

IRS Online Account

As the IRS continues to move more services online to lessen the load on their ag ...

Free Workshop for Small Business Owners

The IRS provides a free recorded workshop to help small businesses owners unders ...