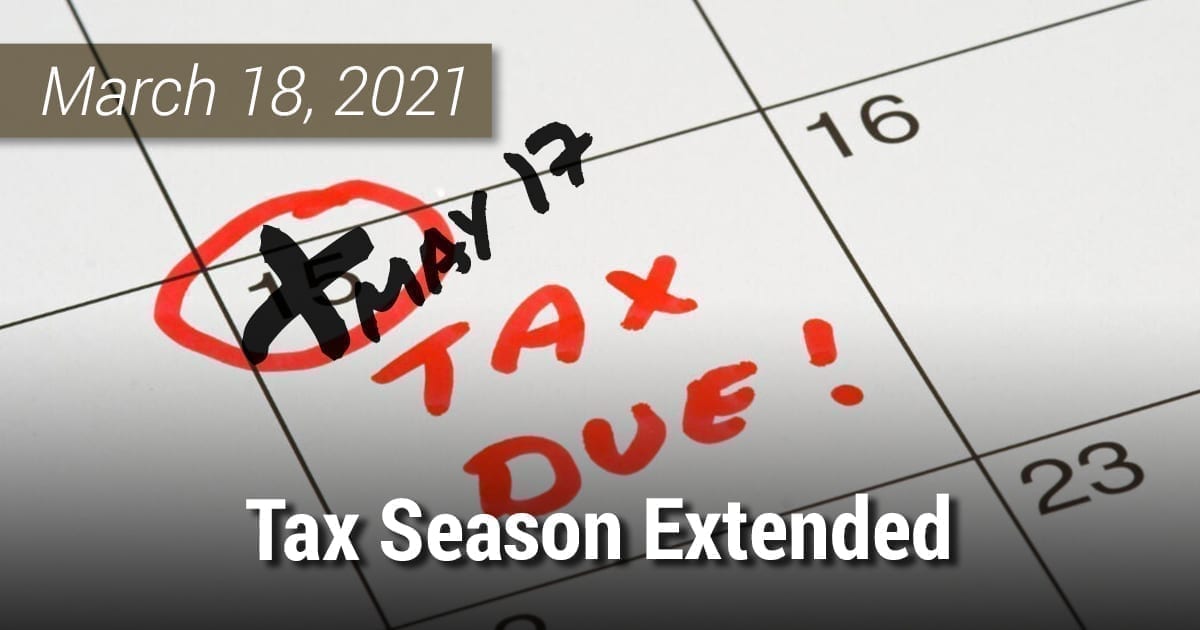

Tax Season Extended

IRS Postpones 4/15 Deadline to 5/17

The IRS announced yesterday, March 17, an extension of the deadline to file 2020 Calendar Year Individual Income Tax Returns and payments due for the 2020 tax year to May 17, 2021.

Deadlines the IRS did NOT Extend:

- 2021 1st Quarter Estimated tax payments due on 4/15/2021

- Any other payment deadlines for other Federal taxes, such as payroll taxes or excise taxes

- 2020 Form 1041 Trust Returns due 4/15/2021

- State tax return deadlines, if applicable

The following press release from the IRS gives additional details to their current deadline extension rules. For many taxpayers, a State return must be filed by 4/15/2021, unless the States conform to the just-released IRS guidelines for May 17, 2021, for filing and payments. The 1st Quarter Federal and State tax payments are still due 4/15/2021, which requires the completion of the 2020 tax return to determine the correct Q1 2021 payment amount.

Our firm will continue to keep our regular deadlines for receiving documents this Saturday, March 20, 2021, to complete the filing by the original filing due dates. If there will need to be an extension of your return, we will let you know and anticipate finalizing the returns shortly after the original filing deadline in late April or May. We do not anticipate extending returns for the entire six months allowed by the extension unless other factors delay your returns.